Each section can be completed at a different time and in no particular order, but to pass, all sections have to be completed within 18 months of passing the first section. In this article, we’ll compare both by looking at what they have in common, how they are different and which path may be right for you depending on your personal and professional goals. The University of Kansas has engaged Everspring, a leading provider of education and technology services, to support select aspects of program delivery. In addition, an MBA can also equip you to be an entrepreneur, you have the potential build and expand your own company.

Certified Public Accountants

Additionally, many schools outside of this top ten list still report above-average salaries. Certified public accountants are usually in demand, and a good CPA can pull in a high five-figure salary. Plus, if they decided not to work for a large company, they could set up shop on their own. This career offers work opportunities in various public and private sectors, from the government to information technology.

- It also “serves them incredibly well at the jumping-off point to a lot of other roles,” she adds.

- MBA degrees like the program offered by Keller can be customized with specializations in a number of different areas, including accounting.

- According to industry statistics, the average salary for MBA holders is around $97,000, with the potential for significant growth.

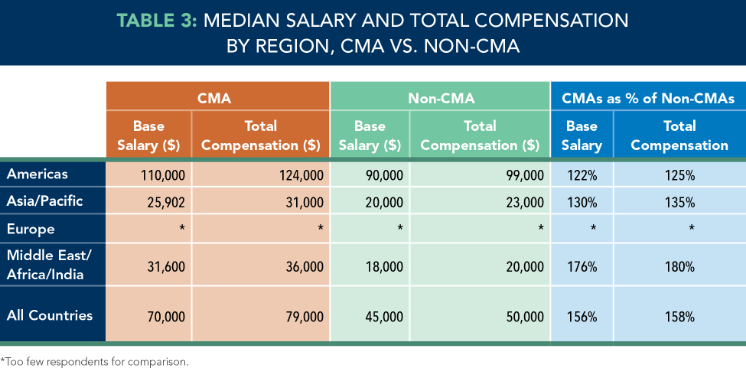

- Considering the entire compensation package beyond the base salary can boost total earnings by tens of thousands of dollars.

How Much Do CPAs Make?

It takes time and effort to earn a CPA designation and therefore to earn an attractive CPA salary. This premium compensates for the rigorous process of obtaining a CPA license, which includes meeting the 150 credit hour educational requirement, passing the CPA exam, and gaining relevant work experience. The investment in becoming a CPA is substantial in terms of time and finances, especially considering the additional educational costs and the effort required to prepare for and pass the CPA exam. According to the Bureau of Labor Statistics (BLS), accountants and auditors earn on average $71,550 annually. However, CPAs with more experience have a greater earning potential, and those who have 20 years of experience could earn up to $150,000 annually. If you are passionate about accounting and finance and want to become an accountant, then becoming a CPA is a good opportunity to demonstrate your expertise.

Student demand for an MBA is surging—but that might be bad news for the U.S. economy

A CPA is best for those focused on specialized accounting, auditing, and finance roles, often leading to positions like CFO or tax advisor. An MBA is a prestigious academic degree designed to equip students with a deep understanding of business leadership and management principles. An MBA program aims to prepare graduates for senior management roles in various sectors by enhancing their strategic thinking, decision-making capabilities, and understanding of corporate finance. The choice between earning a Certified Public Accountant (CPA) designation or an MBA is one that many struggle with, especially if they’re considering a career on the financial side of business. The choice that’s right for you depends on your interests, likes and dislikes, and the trajectory of your career.

Similarly, an MBA graduate might take on an executive position at a large international conglomerate. Or they may decide on a position with a smaller local company that pays less but offers a better work-life balance. Even if you decide not to obtain both an MBA and a CPA license, there isn’t a “best” or “worst” option.

Women are breaking enrollment records at top MBA programs—but more progress is needed, report says

Both an MBA and a CPA will create a number of career options for you, many of which are lucrative. Those who are holders of the CPA designation and wish to go back to school to pursue an MBA will find the resources to study with the CPA firm. You can achieve an MBA even while working part-time as well as full-time cpa vs mba salary at the CPA firm. Making more money in an area with a high cost of living may result in a similar lifestyle as making less money in an area with a low cost of living. A CPA in New York could make over $100,000, but a junior accountant in a different state might only make a median salary under $50,000.

Because you can assume a wide array of roles, many of which earn salaries high in the pay scale, the ceiling for professionals with an MBA is high. Depending on your tuition cost and the role you take, the growth in salary may result in recouping the cost of earning an MBA within a few years. It may sound counterintuitive, but an MBA could ultimately help you to hyper-define your career path if you’re an accountant.

The decision between pursuing an MBA (Master of Business Administration) and obtaining a CPA (Certified Public Accountant) license stands as a fundamental crossroads. This choice involves two distinct paths—one an academic degree and the other a professional designation. Herzing University’s Accounting program does not meet the requirements for a graduate to take the CPA exam in most states.

Post-MBA, Neel went on to work in strategy with Roger Nelson, who ramped up Ernst & Young’s consulting practice. During Neel’s first six years with EY, the consulting business grew fivefold in revenues and was sold to Capgemini in the early 2000s. Since then, Neel has served in a myriad of roles in private equity and investing—and also teaches strategic management courses at Marquette University, which Fortune ranks as having one of the best executive MBA programs.

Some programs also require a graduate degree in accounting or a master of business administration (MBA) with a focus on accounting. MBA programs, known for their broad business education and leadership training, pave the way for graduates to enter high-paying roles across various sectors. According to industry statistics, the average salary for MBA holders is around $97,000, with the potential for significant growth. While both an MBA and CPA can lead to lucrative careers, they each have different earning potential.

The higher salaries often mean more responsibilities at work, which could cause stress, but it depends on the individual. But, not all accountants are CPAs, and it is easier to become an accountant than a CPA. According to the AICPA, which administers and scores the test, most states allow anyone to hold an accountant’s title. Meanwhile, to be granted a license, CPAs must meet certain educational requirements, have experience, and adhere to professional ethics. That’s a huge range because the title broadly covers varying responsibilities. Senior accountants and auditors with high levels of responsibility are typically CPAs.

Leave a Reply